This article is published by The Legal Warning India and written by Advocate Uday Singh.

Money Laundering Explained Simply – How Illegal Money Is Cleaned and Why It Is a Serious Crime

Money laundering is often mentioned in news related to scams, corruption, hawala, drug trafficking, and economic offences.

However, many people still do not clearly understand what money laundering actually means and why it is treated as a grave crime under Indian law.

This article explains money laundering in a simple and practical way — how it works, why it is illegal, and what legal consequences follow.

Information is based on statutory laws, enforcement practices, and publicly available legal principles.

What Is Money Laundering?

Money laundering is the process of making illegally earned money appear legal.

In simple terms, it means:

- Money is earned through illegal activities

- That money is then hidden, layered, or routed

- Finally, it is shown as clean or lawful income

The crime is not just earning illegal money, but trying to disguise its illegal origin.

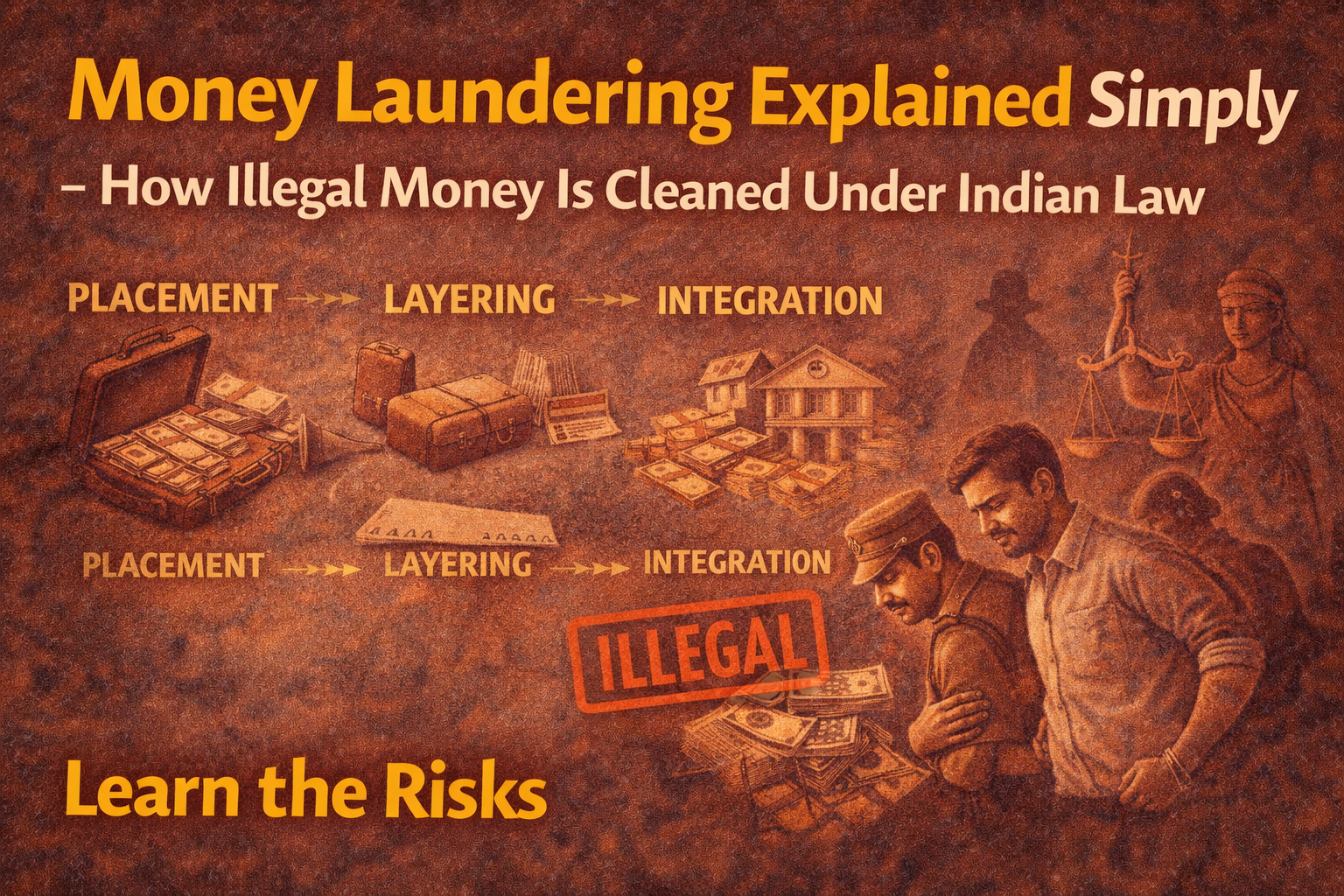

How Money Laundering Works – The Three Basic Stages

1️⃣ Placement

Illegal money is first introduced into the financial system — often through cash deposits, shell businesses, or informal channels.

2️⃣ Layering

The money is moved through multiple transactions to break the audit trail.

This may involve transfers, fake invoices, or overseas routing.

3️⃣ Integration

The money is reintroduced as apparently legitimate income — such as business profits, property investments, or loans.

Common Methods Used for Money Laundering

- Shell companies and fake businesses

- Over-invoicing or under-invoicing

- Real estate transactions

- Cash-intensive businesses

- Informal transfer systems

One widely discussed informal system linked with laundering is hawala.

Hawala Explained: How It Works and Why It Is Illegal in India

Is Money Laundering Illegal in India?

Yes. Money laundering is a serious criminal offence in India.

Indian law treats laundering as a separate offence — even if the original crime occurred earlier.

The focus is on:

- Concealment of illegal proceeds

- Possession or use of tainted money

- Projection of illegal money as clean

Why Money Laundering Is Treated Seriously

Money laundering:

- Supports organised crime

- Encourages corruption

- Harms economic stability

- Weakens public trust in institutions

This is why enforcement agencies adopt a strict approach.

How Money Laundering Is Investigated

Investigations usually involve:

- Tracking financial transactions

- Analysing property and asset records

- Examining digital and banking trails

- Coordination between multiple agencies

Once laundering is suspected, consequences can be severe.

Legal Consequences of Money Laundering

Persons involved may face:

- Arrest and prosecution

- Attachment of property and assets

- Long-term criminal trials

- Serious reputational damage

Ignorance of the source of money is not always a defence.

Difference Between Tax Evasion and Money Laundering

While both involve illegal money, they are different:

- Tax evasion involves hiding income from authorities

- Money laundering involves disguising criminal proceeds

However, tax evasion can sometimes lead to laundering charges if illegal proceeds are concealed.

Why Common People Should Be Careful

People may unknowingly get involved through:

- Allowing bank accounts to be used

- Accepting suspicious business transactions

- Participating in informal money transfers

Even indirect involvement can attract legal scrutiny.

Key Takeaway

Money laundering is not a technical offence — it is a serious crime with far-reaching consequences.

Understanding how it works helps individuals and businesses avoid risky financial behaviour.

Need legal guidance? You may choose to connect for general consultation and information.

▶ Request Online Consultation

▶ Request WhatsApp Consultation

Disclaimer: This article is for general legal information and awareness purposes only. It does not constitute legal advice or solicitation. Communication is purely informational, in compliance with Bar Council of India Rule 36.