Innocent Account Holder in a Money Laundering Case: Legal Reality, Risks, and Remedies in India

This article is published by The Legal Warning India and written by Advocate Uday Singh.

Introduction

Across India, an increasing number of ordinary citizens are finding themselves unexpectedly linked to serious

financial investigations involving money laundering. Students, salaried employees, small business owners,

freelancers, homemakers, and even senior citizens have reported sudden bank account freezes and police inquiries

despite having no criminal intent.

Most such cases arise from cyber fraud transactions, peer-to-peer crypto trades, online business payments,

or misuse of personal bank accounts by third parties. The core issue is not deliberate wrongdoing, but lack of

awareness and unintentional exposure to tainted funds.

What Is Money Laundering Under Indian Law?

Money laundering refers to the process of concealing the origin of illegally obtained money and projecting it

as legitimate income or property. In India, this offence is governed primarily by the

Prevention of Money Laundering Act, 2002 (PMLA).

Under PMLA, a person commits money laundering only if they are involved in the process of handling

“proceeds of crime” with knowledge or intent to disguise their illegal origin.

Who Is an Innocent Account Holder?

An innocent account holder is a person who:

- Did not commit the original (scheduled) offence

- Had no knowledge that the funds were criminal proceeds

- Did not intentionally assist in laundering activities

- Used their bank account for legitimate personal or professional purposes

Despite innocence, such individuals may still face account freezes and investigations during the tracing of

financial trails.

How Innocent People Get Linked to Money Laundering Cases

1. Cyber Fraud Money Routing

Cyber criminals often move stolen funds through multiple accounts to confuse investigators. An innocent

account may be used as a temporary transit point without the holder’s knowledge.

2. P2P Cryptocurrency Transactions

Peer-to-peer crypto trading is a major risk area. Innocent traders may receive money originating from fraud,

even if the crypto transaction itself was legitimate.

3. Business or Freelance Payments

Small businesses and freelancers sometimes receive payments from clients later found to be involved in fraud

or money laundering activities.

4. Allowing Others to Use Your Bank Account

Allowing friends or relatives to operate your bank account or receive money on your behalf is legally risky

and frequently leads to complications.

5. Salary or Commission-Based Schemes

Fraud networks often disguise illegal money movement as jobs, commissions, or task-based earnings.

What Happens When Your Bank Account Is Frozen?

Step 1: Account Restriction

Banks may freeze debit, credit, or both sides of the account based on instructions from law enforcement or

cyber cells.

Step 2: Investigation Tagging

The freeze may be linked to a cyber complaint, FIR, or PMLA inquiry, even if the account holder is not named

as an accused.

Step 3: Inquiry or Summons

The account holder may be asked to explain transactions, submit documents, or cooperate with investigators.

Is Mere Receipt of Money a Crime?

No. Mere receipt of money does not automatically make a person guilty of money laundering. Indian courts

have repeatedly emphasized that criminal intent and knowledge are essential elements of the offence.

Legal Provisions Commonly Involved

- Prevention of Money Laundering Act, 2002

- Bharatiya Nyaya Sanhita (earlier IPC provisions)

- Information Technology Act, 2000

- Relevant cyber crime regulations

Status of Innocent Account Holders

Many individuals misunderstand their legal position. Being questioned does not automatically make someone

an accused. In many cases, the account holder is only a witness or a person providing clarification.

What Innocent Account Holders Should Do Immediately

- Do not panic or ignore notices

- Preserve bank statements and transaction records

- Maintain written communication with authorities

- Avoid informal settlements or third-party interference

Account Unfreeze: Legal Possibility

Account freezes are not permanent punishments. They are temporary investigative measures.

Once innocence is established or the disputed amount is clarified, accounts may be partially or fully restored.

Judicial Safeguards

Indian courts have emphasized proportionality and fairness, often questioning blanket freezes that affect

livelihood and basic rights.

Psychological and Social Impact

Wrongful implication can cause severe stress, reputational damage, and financial hardship.

Awareness and lawful cooperation are essential during this phase.

Preventive Measures

- Never allow third-party use of your bank account

- Avoid receiving funds for unknown persons

- Verify crypto and P2P transactions carefully

- Maintain transparent financial records

- Educate family members about banking risks

Frequently Asked Questions (FAQ)

Can an innocent person be arrested?

Arrest requires legal thresholds and satisfaction of intent. Innocent cooperation reduces risk.

How long can an account remain frozen?

Duration depends on investigation, but prolonged freezes may be legally challenged.

Is crypto trading illegal?

Crypto itself is not illegal, but proceeds of crime are always unlawful.

Conclusion

Innocent account holders increasingly face financial investigations due to the digital economy and cyber fraud.

Indian law does not presume guilt merely due to fund movement. Knowledge, intent, and participation remain key.

With awareness and lawful conduct, innocent individuals can protect their rights.

Request Legal Guidance

If a person is facing issues related to a bank account freeze due to an unknown cyber complaint,

they should be aware of the legal remedies and procedures available under Indian law.

This information is shared strictly for general legal awareness.

Related Legal Awareness Articles

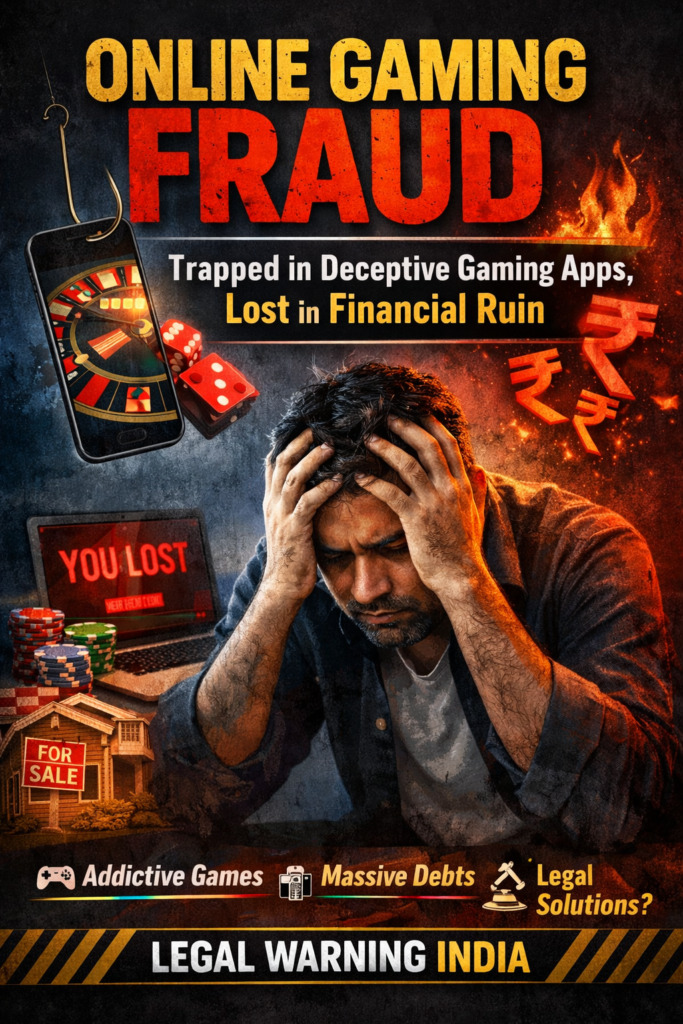

The following articles are shared for educational and legal awareness purposes only:

- Unknown Cyber Complaint ke Karan Bank Account Freeze – Victim Guide

- Cyber Crime Bank Account Unfreeze Application – Legal Process

- Business Bank Account Frozen Due to Cyber Crime – Legal Awareness

- Crypto P2P Transaction & Bank Account Freeze in India

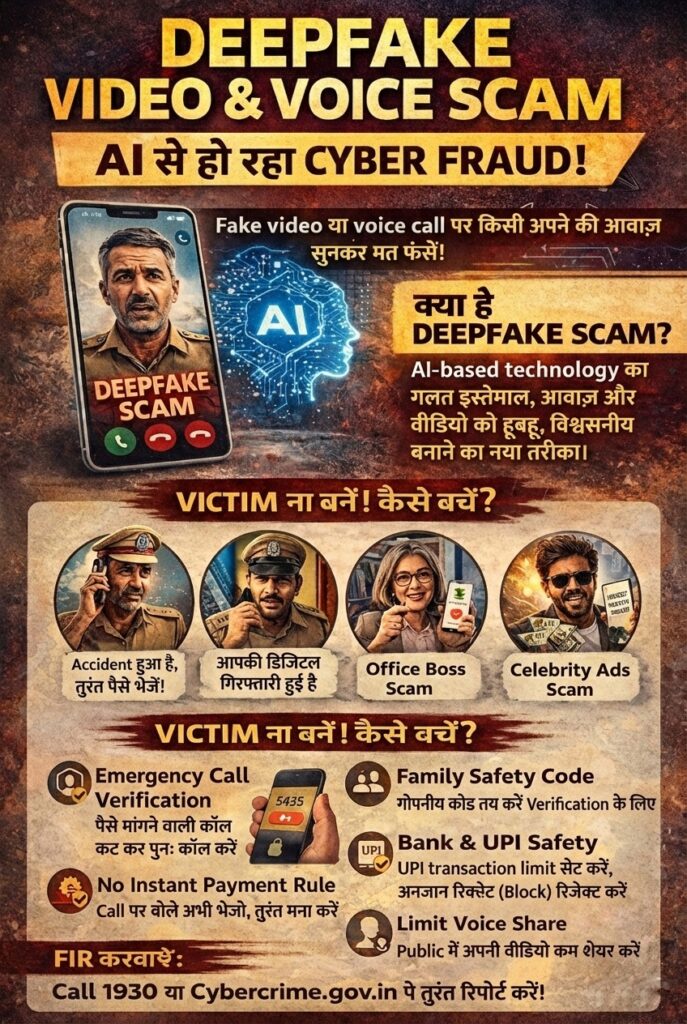

- Deepfake Video & Voice Scam – Cyber Fraud Awareness

Disclaimer: The above links are provided solely for general legal awareness and informational purposes.