This article is published by The Legal Warning India and written by Advocate Uday Singh.

ED Exposes ₹12,000 Crore Cyber Fraud Money Laundering Network – Deep Legal Analysis

The Enforcement Directorate (ED) has reportedly uncovered a massive transnational money-laundering network involving more than ₹12,000 crore generated through cyber-enabled financial frauds. The operation allegedly includes “pig-butchering” scams, fake investment platforms, mule accounts, shell companies, and crypto channels.

Information is based on news reports and publicly available sources.

How the ₹12,000 Crore Cyber Fraud Network Operated

According to investigative disclosures, the network followed a structured, corporate-style laundering mechanism:

- Stage 1 – Fraud Generation: Victims were lured through fake investment apps, IPO schemes, and online trading platforms promising high returns.

- Stage 2 – Mule Accounts: Fraud proceeds were first transferred into multiple “mule” bank accounts.

- Stage 3 – Layering: Funds were rapidly split into hundreds of small transactions across various accounts to avoid detection.

- Stage 4 – Crypto Conversion: The money was converted into cryptocurrency and routed through international exchanges.

This layering technique makes tracing extremely difficult and delays recovery.

What Is a “Pig-Butchering” Scam?

In a pig-butchering scam, fraudsters:

- Build trust with victims over time

- Show fake profits initially

- Encourage larger investments

- Disappear once substantial funds are transferred

Many such scams are linked to cross-border syndicates operating from Southeast Asia.

Legal Provisions That May Apply

Such cases typically involve multiple legal frameworks:

- Prevention of Money Laundering Act (PMLA)

- Information Technology Act provisions

- Bharatiya Nyaya Sanhita (BNS) or IPC fraud-related sections

Authorities may freeze bank accounts, attach properties, and initiate prosecution under these laws.

Impact on Ordinary Citizens

Many individuals unknowingly become part of the chain:

- Bank accounts get frozen due to linked transactions

- Business operations are disrupted

- Salary accounts may be blocked during investigation

If your bank account is frozen during a cyber investigation, understanding the process is crucial. You may read:

👉

Cyber Crime Investigation Timeline in India – What to Expect

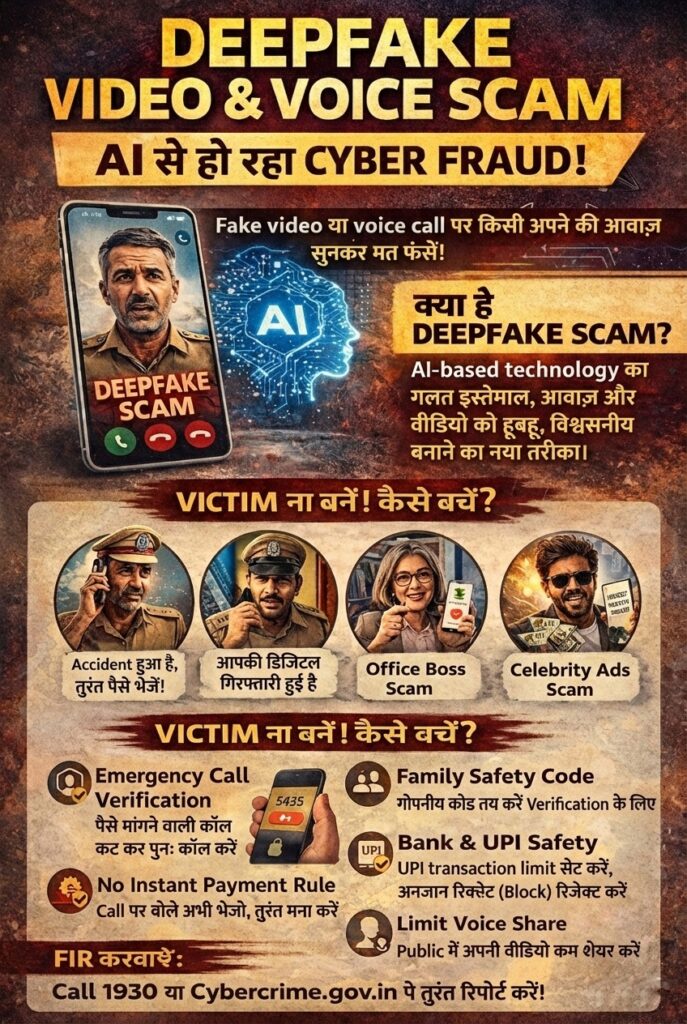

Connection With Digital Arrest & Central Agency Scams

In many recent cases, scammers misuse the names of central agencies such as ED, CBI, or Cyber Crime Units to threaten victims. To understand the legal reality behind such claims, read:

👉

Cyber Crime Digital Arrest: Can Police Arrest on WhatsApp?

What Should Victims Do?

- Immediately inform your bank

- Call cyber crime helpline 1930

- File complaint on official cyber crime portal

- Preserve all transaction records

- Respond to investigating authorities properly

Delay can weaken recovery chances and complicate investigation.

Key Legal Takeaway

The ₹12,000 crore exposure highlights how sophisticated cyber-enabled fraud networks have become. Awareness, documentation, and timely legal response are essential to protect financial and legal interests.

Disclaimer: This article is for general legal information and awareness purposes only. It does not constitute legal advice or solicitation. Communication is purely informational, in compliance with Bar Council of India Rule 36.

Get general legal information and consultation support.