This article is published by The Legal Warning India and written by Advocate Uday Singh.

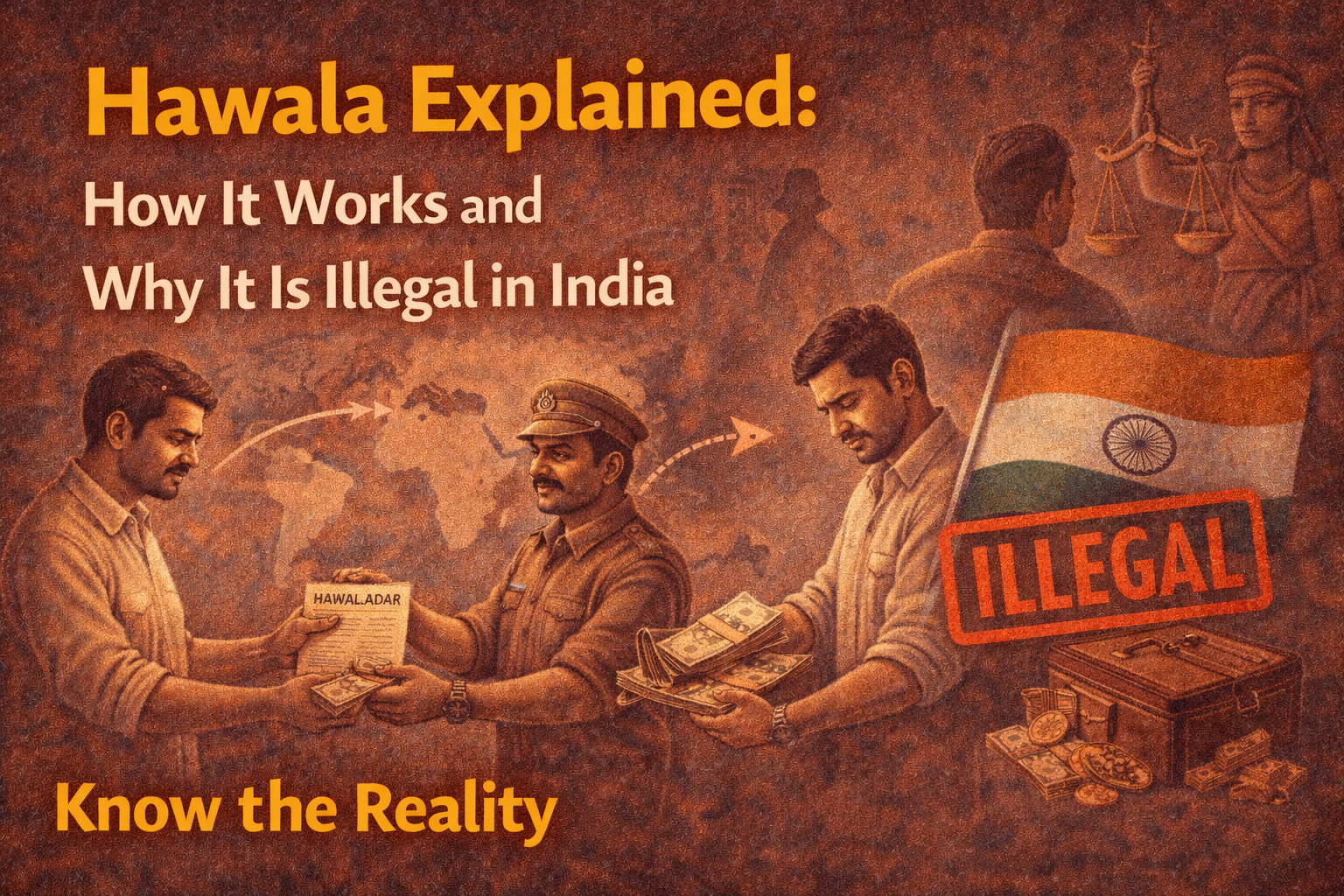

Hawala Explained: How It Works and Is It Legal or Illegal in India?

Hawala transactions often surface in news reports related to black money, tax evasion, terrorism financing, and economic offences.

Despite frequent references, many people do not clearly understand how hawala works and whether it is legal or illegal under Indian law.

This article explains the hawala system in simple terms, its working mechanism, legal status in India, and the serious consequences attached to it.

Information is based on statutory laws, enforcement practices, and publicly available legal principles.

What Is Hawala?

Hawala is an informal money transfer system where money is transferred from one place to another without physically moving cash and without using formal banking channels.

It operates entirely on trust, networks, and informal accounting.

No bank, no written contract, and no official record is involved.

How Hawala Works – Step-by-Step

The basic hawala mechanism works as follows:

- A sender gives money to a local hawala operator (Hawaladar)

- The hawaladar contacts another hawala operator at the destination

- The receiver collects the equivalent amount from the second operator

- Settlement between operators happens later through trade, cash, or accounts

Money itself does not cross borders — only trust and instructions do.

Why Do People Use Hawala?

- Speed of transfer

- No banking documentation

- Avoidance of taxes and reporting

- Bypassing foreign exchange controls

These very features also make hawala attractive for illegal activities.

Is Hawala Legal or Illegal in India?

Hawala is illegal in India.

Hawala transactions violate multiple Indian laws because they:

- Bypass authorised banking channels

- Evade regulatory oversight

- Facilitate unaccounted money flow

Any transfer of money outside authorised systems is treated as an offence.

Laws Under Which Hawala Is Punishable

Hawala transactions can attract action under:

- Foreign Exchange Management laws

- Prevention of Money Laundering provisions

- Income tax regulations

- Anti-terror and organised crime laws (in serious cases)

Multiple agencies may investigate the same transaction.

Common Myths About Hawala

- “It is legal if no cash crosses border” – False

- “Only big criminals use hawala” – False

- “Small amounts are ignored” – False

Even small transactions can trigger serious legal consequences.

How Hawala Transactions Are Detected

- Surveillance of suspicious financial patterns

- Information sharing between agencies

- Digital trail through communications

- Search and seizure operations

Technology has made detection easier than before.

Legal Consequences of Hawala Involvement

Involvement in hawala may result in:

- Arrest and detention

- Attachment of property

- Heavy monetary penalties

- Long-term criminal proceedings

Courts treat such offences seriously due to their economic impact.

Difference Between Hawala and Legal Money Transfer

| Hawala | Legal Banking Transfer |

|---|---|

| Informal & unregulated | Regulated by RBI |

| No transaction record | Proper documentation |

| Illegal in India | Fully legal |

Why Hawala Is Considered Dangerous

Hawala systems:

- Fuel black money economy

- Enable tax evasion

- Facilitate organised crime

- Threaten financial stability

This is why enforcement agencies adopt a zero-tolerance approach.

Key Takeaway

Hawala is illegal in India regardless of amount or intention.

Using informal money transfer systems exposes individuals to severe criminal and financial liability.

Legal banking channels are the only safe and lawful option.

Need legal guidance? You may choose to connect for general consultation and information.

▶ Request Online Consultation

▶ Request WhatsApp Consultation

Disclaimer: This article is for general legal information and awareness purposes only. It does not constitute legal advice or solicitation. Communication is purely informational, in compliance with Bar Council of India Rule 36.

Related Legal Guidance

-

Arrest Without Warrant in Non-Serious Offences – What the Law Actually Allows

-

Illegal Arrest in India – Compensation, Remedies and Police Accountability

-

Police Station Call Without Notice – Legal Rights Explained

-

Police Asking for Compromise in Criminal Case – Legal Reality

-

Civil Dispute Me FIR Kab Ho Sakti Hai? Legal Reality

-

NDPS Act in India – Arrest, Bail, Quantity and Legal Remedies