Online Payment & Recovery Issues in India – Legal Remedies Explained

This article is published by The Legal Warning India and written by Advocate Uday Singh.

India has witnessed an unprecedented rise in digital transactions. UPI, mobile wallets, net banking, and online payment apps have made money transfer instant and convenient. However, with this convenience comes a sharp rise in online payment disputes, frauds, and recovery issues.

Every day, people lose money due to:

- UPI frauds

- Wrong bank transfers

- Online scams

- Non-refunded payments

- Business payment defaults

The most common question people ask is:

“Online payment ho gaya, paisa fas gaya – kya legally recover ho sakta hai?”

The answer is: YES, depending on facts and timely action.

What Are Online Payment & Recovery Issues?

Online payment recovery issues arise when:

- Money is transferred digitally but goods/services are not delivered

- UPI or net banking payment is made by mistake

- Online seller refuses refund

- Fraudster cheats through fake links or calls

- Business partner receives payment and disappears

These disputes involve both civil and criminal law, depending on intention.

Most Common Types of Online Payment Problems in India

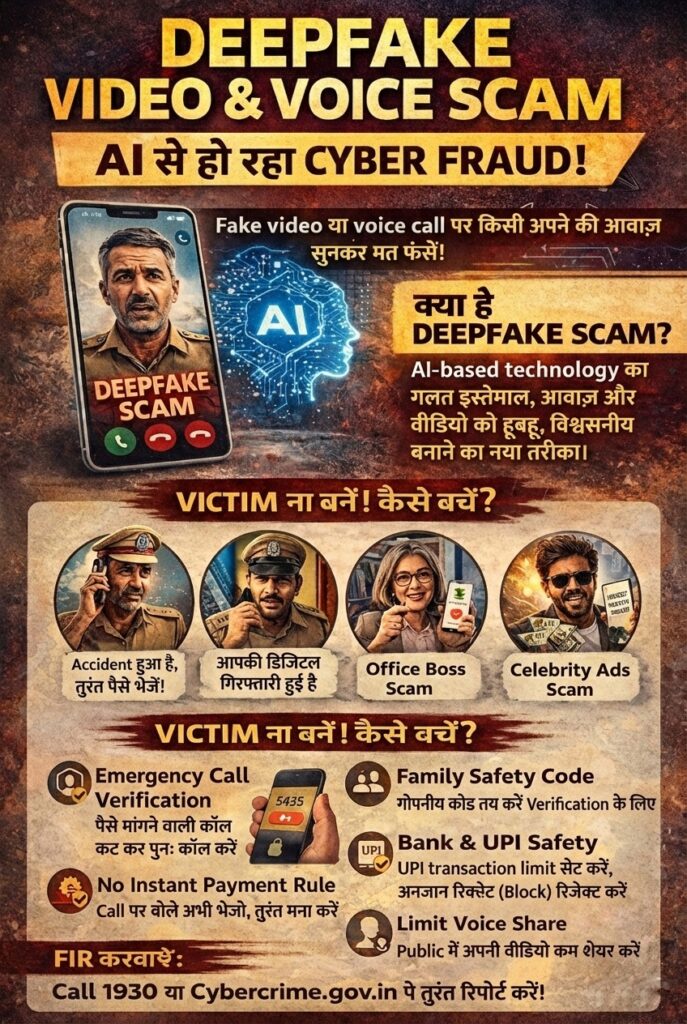

1. UPI Fraud & Scam Calls

Fraudsters trick users into approving UPI collect requests or sharing OTPs.

2. Wrong Bank Transfer

Money transferred to wrong account due to incorrect details.

3. Online Shopping Fraud

Payment done, but product never delivered or fake product received.

4. Business Payment Recovery Issues

Payments made to vendors, freelancers, or partners who refuse to deliver.

5. Wallet / App Refund Not Received

Refund initiated but never credited.

Is Online Payment Fraud a Criminal Offence?

Yes, if dishonest intention exists.

Online payment fraud may attract:

- Cheating provisions

- Cyber crime laws

- Criminal breach of trust

However, not all online payment disputes are criminal. Many are purely civil recovery matters.

First Step – Immediate Action After Online Fraud

Time is the most critical factor.

- Immediately inform bank / app

- Block UPI or account if needed

- Preserve screenshots & transaction IDs

- Do not delete chats or emails

Delay reduces recovery chances.

Legal Remedies Available for Online Payment Recovery

1. Cyber Crime Complaint

For fraud cases, cyber crime complaint is important.

Related Reading:

Cyber Crime Legal Help in India – Online Fraud & UPI Issues

2. Legal Notice for Payment Recovery

In business or known-person disputes, a legal notice is extremely effective.

Legal notice demands:

- Refund

- Delivery of service

- Payment recovery

Many disputes resolve at notice stage.

3. Civil Suit for Online Payment Recovery

Civil suit can be filed for:

- Recovery of amount

- Interest

- Compensation

This applies to:

- Wrong transfer cases

- Business disputes

- Service non-delivery

4. Consumer Court Complaint

If payment was made to an online platform or service provider, consumer complaint may apply.

What If Bank or App Refuses Help?

Banks and apps often deny liability. However:

- They have regulatory obligations

- Delay or negligence can be challenged

- Legal notice increases pressure

Can Wrong Bank Transfer Be Recovered?

Yes, but it requires:

- Immediate reporting

- Cooperation of receiving bank

- Legal intervention if receiver refuses

Courts have allowed recovery in genuine cases.

Limitation Period – Don’t Sit Quiet

Even online payment recovery has limitation periods.

Waiting silently weakens your legal position.

Common Mistakes People Make

- Delaying complaint

- Only calling customer care

- Not sending legal notice

- Deleting transaction proof

- Believing verbal assurances

Prevention Tips for Digital Payments

- Never share OTP or approve unknown requests

- Double-check payment details

- Use verified sellers

- Save transaction records

- Act immediately if fraud occurs

Internal Legal Reading (Recommended)

Frequently Asked Questions (FAQs)

Q. Can UPI fraud money be recovered?

Yes, if reported immediately and legally followed up.

Q. Is police complaint mandatory?

For fraud, yes. For civil recovery, legal notice is first step.

Q. Can I file case against online app?

Yes, depending on negligence and facts.

This article is for general legal information and awareness purposes only. It does not constitute legal advice or solicitation. Communication is purely informational, in compliance with Bar Council of India Rule 36.