Salary Account Debit Freeze Due to Cyber Complaint: Legal Position & Remedies in India

This article is published by The Legal Warning India and written by Advocate Uday Singh.

Introduction: When a Salary Account Is Suddenly Frozen

For salaried individuals, a salary account is the primary source of daily survival.

In recent times, many employees across India have faced a sudden shock when their

salary account is debit-frozen due to a cyber crime complaint.

Such freezes often happen without prior notice, leaving individuals unable to withdraw

money for rent, medical expenses, EMIs, or household needs.

What Does “Salary Account Debit Freeze” Mean?

A debit freeze means that the account holder:

- Cannot withdraw cash

- Cannot use UPI, debit card, or net banking

- May still receive salary credit (in some cases)

The freeze is usually imposed after a bank receives instructions from a cyber crime unit

or law enforcement authority during investigation of an online fraud.

Why Are Salary Accounts Frozen in Cyber Crime Cases?

Salary accounts are commonly frozen when:

- A cyber fraud amount is traced to the account

- The account is suspected to be a “layer” or “mule” account

- Money received from an unknown source is under investigation

- A third-party cyber complaint mentions the account

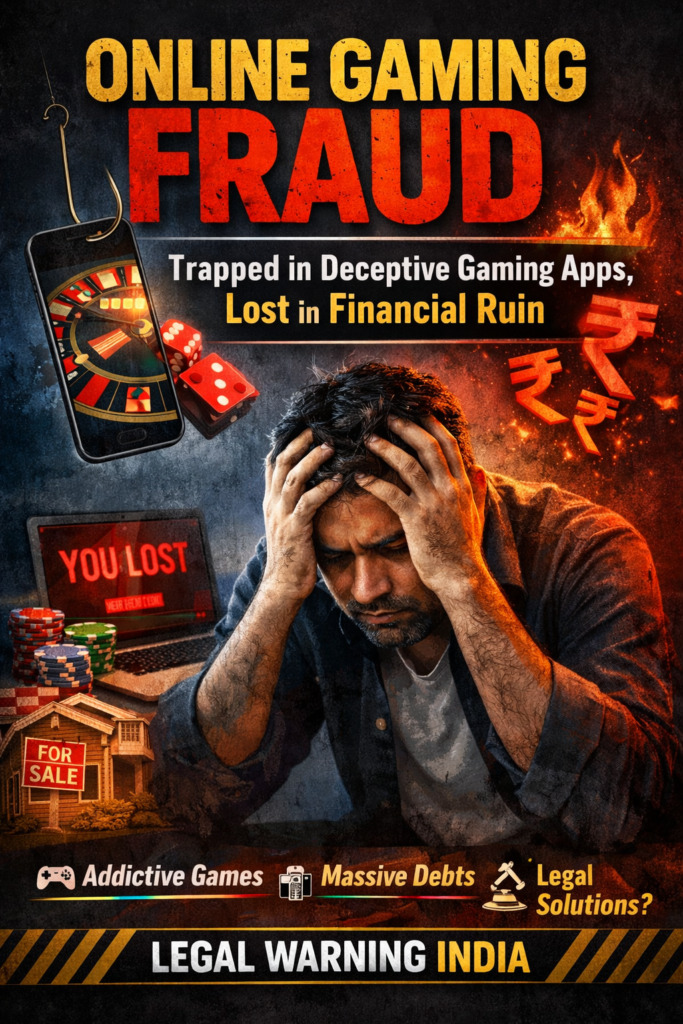

- Online gaming, trading, or wallet transactions are flagged

Importantly, many salary account holders are victims or innocent receivers,

not accused persons.

Legal Authority Behind Account Freeze

Cyber crime units may instruct banks to freeze accounts under:

- Information Technology Act, 2000 (Cyber fraud investigation)

- Banking regulations and RBI advisories

- Investigative powers under criminal procedure laws

- Bharatiya Nyaya Sanhita (BNS), 2023 in fraud-related offences

However, such power must be exercised reasonably and proportionately.

Is Freezing a Salary Account Always Legal?

Freezing of accounts for investigation is legally permissible,

but courts have repeatedly observed that:

- Entire account should not be frozen unnecessarily

- Salary and livelihood needs must be considered

- Indefinite freeze without review may be challenged

In several cases, courts have directed authorities to allow

partial debit or limited withdrawal,

especially where the account holder is not an accused.

Rights of a Salary Account Holder

- Right to be informed about reason for freeze

- Right to submit explanation and documents

- Right to request partial debit for livelihood

- Right to seek review of prolonged freeze

Immediate Steps to Take if Your Salary Account Is Frozen

1. Contact the Bank Immediately

Ask for written details of the freeze:

cyber cell reference number, police station, and date of instruction.

2. Identify the Cyber Crime Authority

Find out which cyber crime unit or police station has issued the freeze request.

3. Prepare Transaction Explanation

Maintain salary slips, bank statements, employment proof,

and explanation for any disputed credit.

4. Submit Representation to Cyber Crime Unit

A written request explaining innocence and hardship is often required

to review or relax the freeze.

Can Salary Be Credited During Freeze?

In many cases, banks allow credit transactions (salary deposits)

while debit remains restricted.

However, crediting does not automatically mean withdrawal is allowed.

What If the Freeze Continues for a Long Time?

If a salary account remains frozen for an unreasonable period,

legal remedies may include:

- Escalation to senior cyber officials

- Bank grievance redressal

- Legal representation for review

- Judicial intervention in appropriate cases

Related Cyber Crime Awareness

-

Cyber Crime Bank Account Unfreeze – Legal Process

-

Online Sextortion & Blackmail – Legal Awareness

-

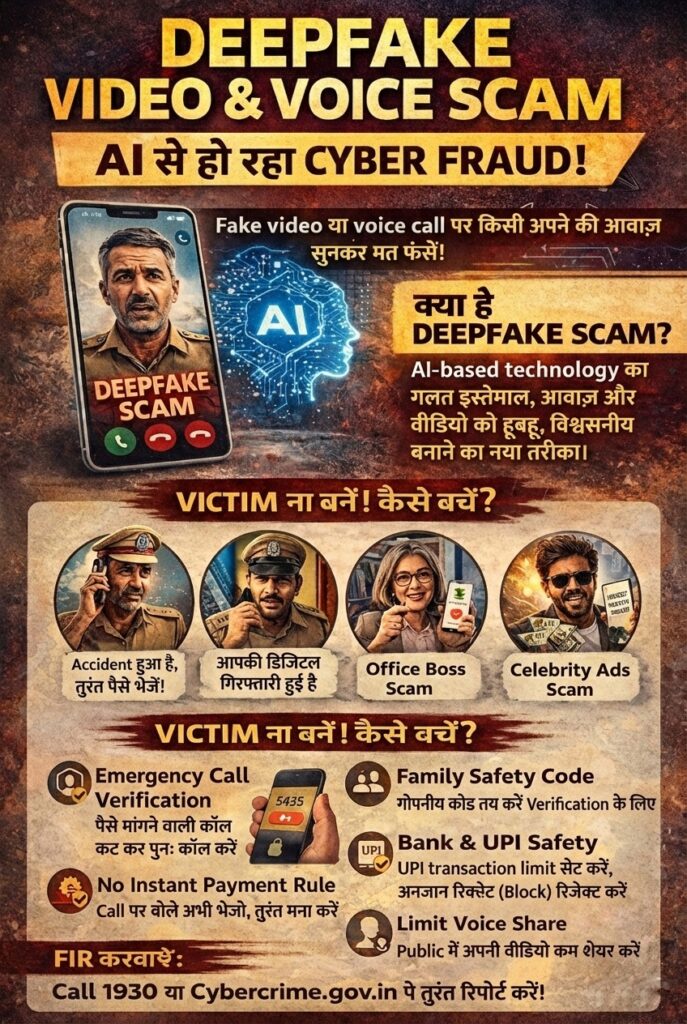

Deepfake Video & Voice Scam – Legal Awareness

Legal Awareness Note

If a person is facing issues related to salary account debit freeze due to a cyber complaint,

they should be aware of the legal remedies and procedures available under Indian law.

This information is shared solely for general legal awareness and educational purposes.

Request Online Legal Information

Disclaimer

This article is published by The Legal Warning India and written by Advocate Uday Singh

for general legal awareness only.

It does not constitute legal advice, advertisement, or solicitation,

and is published in compliance with Bar Council of India Rule 36.

Information is based on publicly available legal provisions,

reported cyber crime patterns, and general awareness sources.