This article is published by The Legal Warning India and written by Advocate Uday Singh.

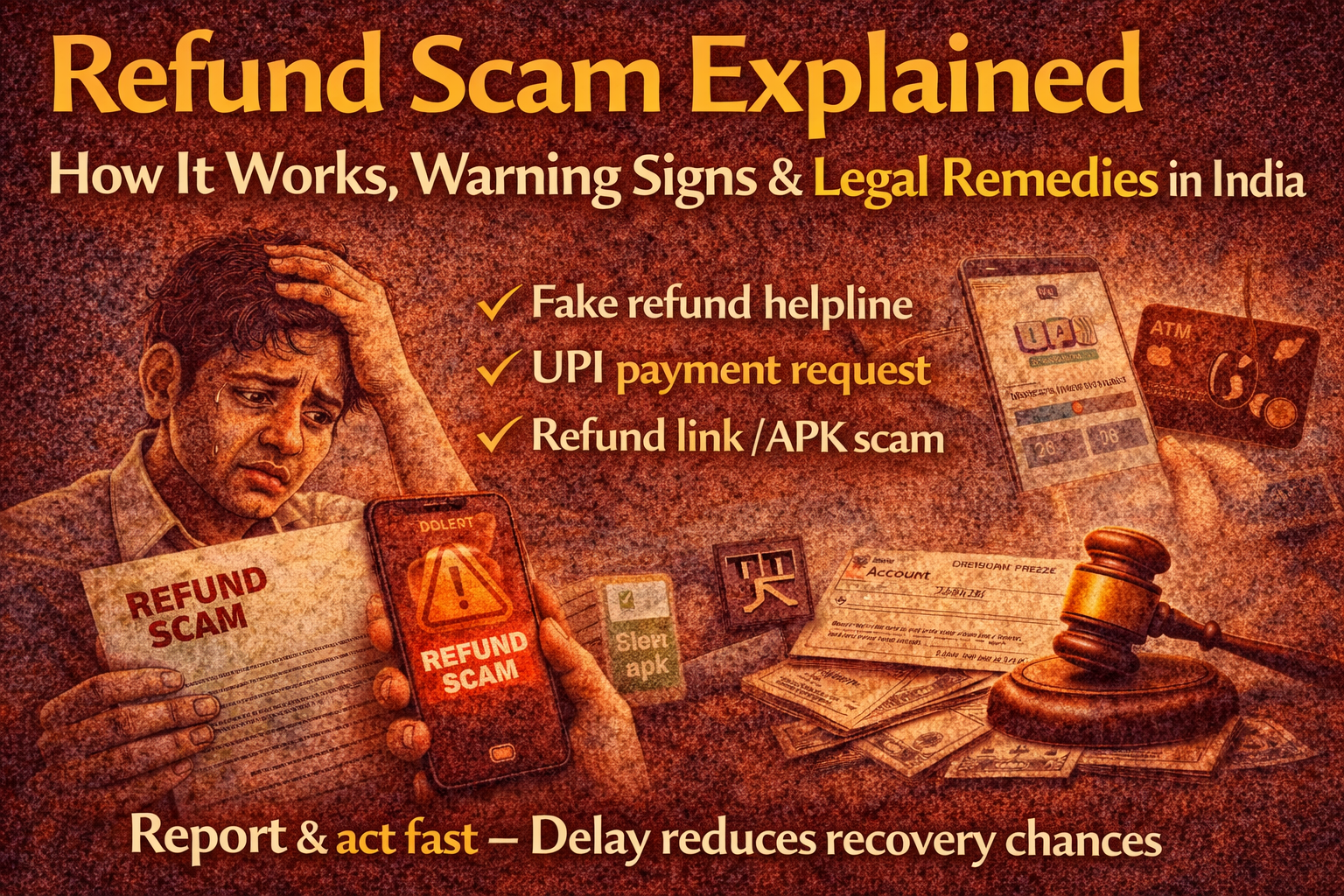

Refund Scam Explained – How It Works, Warning Signs & Legal Remedies in India

Refund scams are rapidly increasing in India, especially in online shopping, travel bookings, digital payments, and service cancellations.

Victims often realise the fraud only after money is debited instead of refunded.

This article explains in detail:

- What a refund scam actually is

- How scammers trap victims

- What mistakes people make under panic

- Immediate legal and practical remedies

Information is based on cyber fraud patterns, Indian legal principles, and publicly available sources.

What Is a Refund Scam?

A refund scam occurs when a fraudster pretends to process a refund but instead:

- Steals money from the victim’s bank account

- Gains unauthorised access to UPI or cards

- Installs remote access or phishing tools

The scam exploits urgency, trust, and confusion around refunds.

Common Refund Scam Scenarios

1️⃣ Online Shopping Refund Scam

Victim contacts seller for refund → scammer pretends to be customer support → asks for UPI approval or OTP → money gets debited.

2️⃣ Flight / Train / Hotel Cancellation Scam

Fake helpline numbers on Google → fraudster claims refund processing → asks for screen sharing or UPI collect request.

3️⃣ UPI “Reverse Payment” Scam

Scammer claims money will come back → actually sends a payment request → victim unknowingly approves debit.

4️⃣ Fake Refund Link / APK Scam

Victim clicks refund link → installs malicious app → account gets compromised.

Why Refund Scams Work So Easily

- Victims expect refunds and lower their guard

- Fraudsters create urgency (“refund will expire”)

- UPI interfaces confuse debit vs credit

- Fake customer care numbers look genuine

Scammers rely more on psychology than technology.

Warning Signs You Should Never Ignore

- Being asked to share OTP or PIN

- Asked to approve a “refund” request on UPI

- Asked to install AnyDesk / TeamViewer

- Customer care number found only via ads

No legitimate refund process requires OTP, PIN, or remote access.

Immediate Steps If You Are a Victim

✔ Block Bank & UPI Immediately

Contact your bank and payment app instantly.

✔ Preserve All Evidence

- Transaction IDs

- Screenshots of chats and calls

- Fake links or numbers

✔ File Cyber Crime Complaint

Early reporting improves chances of account freezing.

Is Refund Scam a Criminal Offence?

Yes. Refund scams may involve:

- Cheating and fraud

- Identity misuse

- Unauthorised electronic access

Such acts are treated as serious cyber offences under Indian law.

Can the Lost Money Be Recovered?

Recovery depends on:

- Speed of complaint

- Bank response time

- Trail of transactions

Delay significantly reduces recovery chances.

Common Mistakes Victims Make

- Waiting too long to report

- Trusting fraudsters again for “reversal”

- Deleting messages or call logs

- Feeling embarrassed and staying silent

Silence only protects the scammer.

How to Stay Safe from Refund Scams

- Always use official apps/websites

- Never Google customer care numbers blindly

- Never approve unknown UPI requests

- Remember: Refund = Credit, not Debit

Related Legal Guidance

Conclusion

Refund scams succeed because victims expect money back, not money out.

Awareness, quick action, and correct legal steps are the only effective defence.

If something feels urgent or confusing, pause — scammers depend on panic.

Disclaimer: This article is for general legal information and awareness purposes only. It does not constitute legal advice or solicitation. Communication is purely informational, in compliance with Bar Council of India Rule 36.