Health Insurance Claim Rejected in India – Legal Rights, Reasons & Step-by-Step Remedy

This article is published by The Legal Warning India and written by Advocate Uday Singh.

Information is based on statutory provisions, IRDAI regulations, consumer court rulings, and publicly available sources.

Health Insurance Claim Rejection – India’s Most Common Insurance Problem

Across India, health insurance claim rejection is one of the most searched and stressful legal issues. Families usually face rejection after hospital discharge, when bills are already paid and financial pressure is high.

People commonly search online:

- Why was my health insurance claim rejected?

- Can I take legal action against insurance company?

- Is claim rejection final or can it be challenged?

This article explains the legal rights, common rejection tricks, and exact legal remedies available in India.

Most Common Reasons for Health Insurance Claim Rejection

1️⃣ Pre-Existing Disease Allegation

Insurance companies often reject claims by alleging that the illness was pre-existing, even when:

- No prior medical record exists

- Disease was diagnosed for the first time

Legal position: The burden of proof lies on the insurer, not the policyholder.

2️⃣ Policy Terms & Hidden Exclusions

Claims are rejected citing fine-print exclusions that were never clearly explained at the time of policy sale.

3️⃣ Delay in Intimation or Documentation

Minor delays are often used as an excuse to deny genuine claims, which courts have repeatedly disapproved.

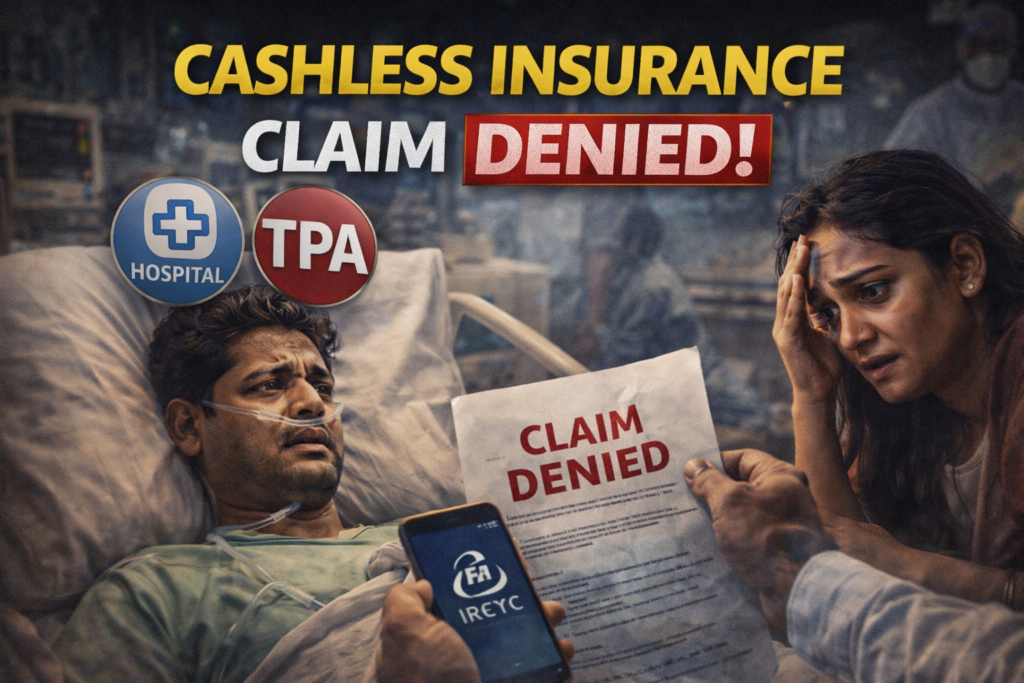

4️⃣ Cashless Claim Denial by TPA

Many hospitals deny cashless approval, forcing patients to pay upfront, followed by reimbursement rejection.

Is Health Insurance Claim Rejection Final?

No. Claim rejection is not final under Indian law.

Health insurance disputes fall under:

- Consumer Protection Act

- IRDAI Regulations

Wrongful rejection can lead to:

- Full claim amount

- Interest for delay

- Compensation for mental harassment

Step-by-Step Legal Remedy After Claim Rejection

Step 1: Written Representation to Insurance Company

Always demand a written reasoned rejection letter.

Step 2: File Complaint with IRDAI

IRDAI grievance portal is a mandatory escalation step before litigation.

Step 3: Legal Notice to Insurance Company

A well-drafted legal notice often results in settlement without court proceedings.

Step 4: Consumer Court Case

You can file a consumer complaint seeking:

- Claim amount

- Interest

- Compensation

Important Documents for Insurance Legal Case

- Insurance policy document

- Hospital bills & discharge summary

- Claim form & rejection letter

- Medical records

Time Limit to Challenge Health Insurance Claim Rejection

Delay can weaken your case. Legal action should be taken as early as possible after rejection.

Related Legal Awareness Articles

- Train Se Girkar Death – Railway Compensation & Legal Process

- Hit and Run Accident Insurance Claim – Legal Process

- Train Accident Injury – Railway Compensation & Legal Process

Conclusion: Health Insurance Law Protects Policyholders

Health insurance claim rejection is one of the biggest causes of financial distress in India, but law strongly protects genuine policyholders. Most rejections can be successfully challenged with correct legal steps.

Disclaimer: This article is for general legal information and awareness purposes only. It does not constitute legal advice or solicitation. Communication is purely informational, in compliance with Bar Council of India Rule 36.