Cyber Crime Investigation Timeline in India – How Much Time Does It Take?

This article is published by The Legal Warning India and written by Advocate Uday Singh.

Introduction

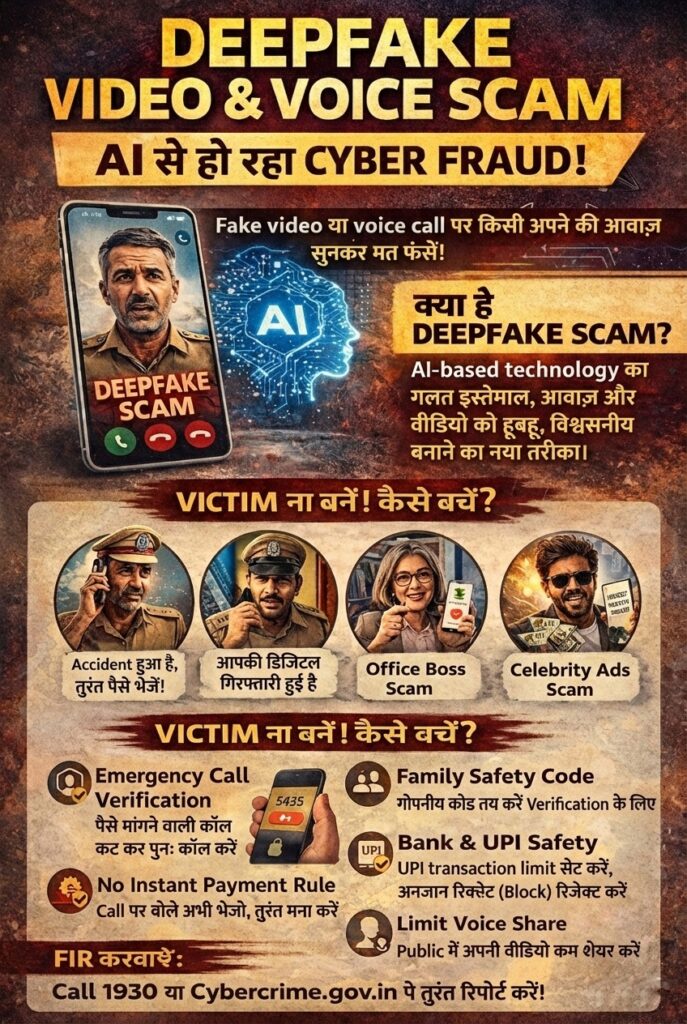

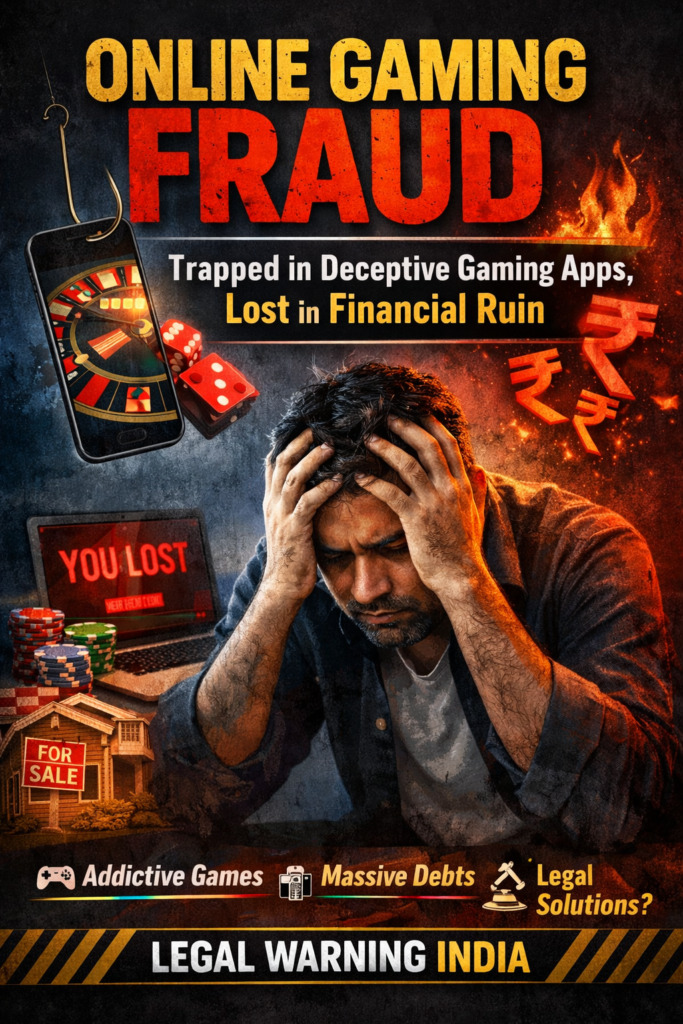

With the rapid rise in online frauds, identity thefts, phishing attacks, crypto scams, and bank account freezes,

one of the most common questions faced by victims is:

“How much time does a cyber crime investigation actually take in India?”

Unlike traditional crimes, cyber crime investigations involve multiple technical, financial, and jurisdictional

layers. This article explains the realistic investigation timeline, step by step, in a clear and practical manner.

What Triggers a Cyber Crime Investigation?

A cyber crime investigation usually begins when:

- A complaint is filed on the official cyber crime reporting platform or at a cyber police station

- A bank flags suspicious transactions and reports them to authorities

- A third-party complaint links your account or device to a suspected fraud

- Payment gateways or digital platforms share suspicious activity reports

Stage 1: Complaint Registration (0–7 Days)

Once a complaint is filed, cyber police first examine whether the matter discloses a cognizable offence.

During this stage:

- Initial facts are verified

- Basic transaction data is collected

- Bank accounts may be temporarily frozen as a precautionary step

This stage is generally completed within a few days, but delays may occur due to workload or incomplete information.

Stage 2: Preliminary Technical Analysis (7–30 Days)

After registration, authorities begin technical verification, which may include:

- Tracing IP addresses and digital footprints

- Reviewing transaction trails

- Seeking information from banks, wallet providers, or exchanges

- Link analysis between accounts

This phase is crucial and often time-consuming because multiple institutions are involved.

Stage 3: Bank Account Freeze & Financial Scrutiny (15–90 Days)

In many cases, especially online fraud and crypto-related matters, bank accounts are frozen during investigation.

Account freeze may continue until:

- Source of funds is verified

- Role of the account holder is clarified

- Required confirmations are received from multiple agencies

For innocent account holders, this phase becomes the most stressful due to salary blockage or business disruption.

Stage 4: Jurisdictional Coordination (30–120 Days)

Cyber crimes frequently involve:

- Multiple states

- Different police jurisdictions

- Inter-bank coordination

Requests for information are sent through official channels, which adds to the timeline.

Stage 5: Legal Assessment & Case Progression (3–12 Months)

Depending on complexity, the case may:

- Proceed toward charge-sheet

- Be closed if no evidence is found

- Remain under extended investigation

Serious cases involving large financial trails or organized fraud networks often take longer.

Why Cyber Crime Investigations Take Time

- Dependence on digital evidence

- Delay in third-party responses

- Cross-border elements

- Heavy caseload on cyber cells

- Requirement of technical expertise

What Victims Should Do During Investigation

- Maintain all transaction and communication records

- Cooperate with authorities when asked

- Avoid panic withdrawals or new transactions

- Submit clarifications in writing where required

- Stay informed about procedural rights

Important Note for Innocent Account Holders

An account freeze does not automatically mean guilt. Many individuals are affected due to:

- Unknown third-party complaints

- P2P transactions

- Receiving funds unknowingly linked to fraud

Awareness of procedure is essential to avoid misinformation and unnecessary fear.

How to speed up investigation?

Request Legal Guidance

If a person is facing issues related to a bank account freeze due to an unknown cyber complaint,

they should be aware of the legal remedies and procedures available under Indian law.

This information is shared strictly for general legal awareness.

Related Legal Guidance & Awareness Articles

Readers seeking deeper legal awareness on cyber crime, bank account freezes,

and online financial frauds may refer to the following informational resources

published by The Legal Warning India:

- Business Bank Account Freeze Due to Cyber Crime – Legal Awareness Guide

- Crypto P2P Transaction & Bank Account Freeze – Legal Explanation

- Unknown Cyber Complaint Leading to Account Freeze – Victim Awareness

- Innocent Account Holder in Money Laundering Cases – Legal Perspective

- Cyber Crime Bank Account Unfreeze Application – Step-by-Step Awareness

These articles are shared strictly for public legal awareness and understanding

of procedural safeguards under Indian law.

Disclaimer

This article is published for general legal awareness purposes only.

It does not constitute legal advice, solicitation, or advertisement in any form.

Timelines mentioned are indicative and may vary depending on facts, jurisdiction,

and investigative requirements.