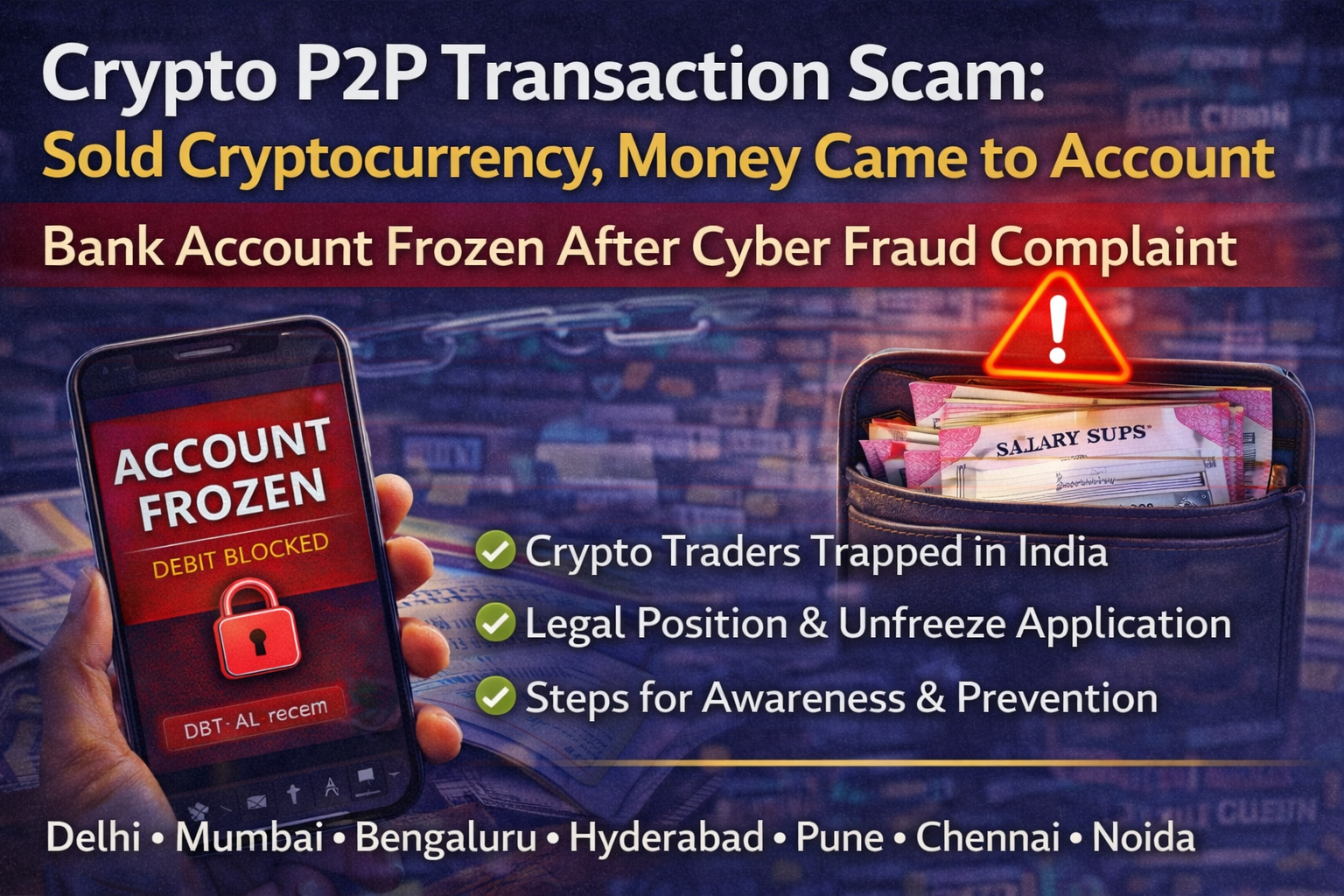

Crypto P2P Transaction Scam: Sold Cryptocurrency, Money Credited — Why Bank Accounts Are Being Frozen in India

This article is published by The Legal Warning India and written by Advocate Uday Singh.

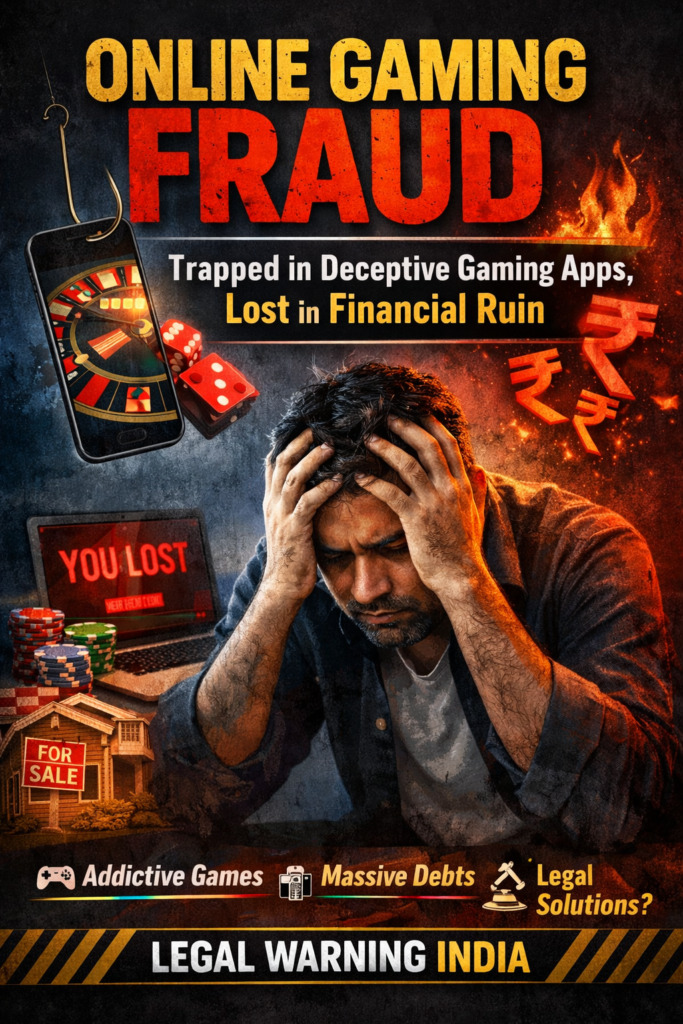

Introduction: A Growing Crypto Panic in India

Across India, thousands of individuals are facing sudden bank account freezes after selling cryptocurrency

through Peer-to-Peer (P2P) platforms. In most cases, the crypto transaction was genuine, the seller acted

without criminal intent, and yet the entire bank account — including salary or business funds — was frozen

after a cyber crime complaint.

This article explains why such freezes occur, the legal framework behind them, the rights of innocent crypto

traders, and the correct procedural path for account unfreezing — strictly for legal awareness.

What Is a Crypto P2P Transaction?

A P2P (Peer-to-Peer) crypto transaction allows individuals to buy or sell cryptocurrency directly with each

other, usually via platforms that act as escrow intermediaries.

The platform does not handle fiat currency. Instead:

- The buyer transfers money directly to the seller’s bank account

- The seller releases cryptocurrency from escrow

- The transaction completes without direct bank involvement

While legal, this system carries inherent risks related to the source of funds.

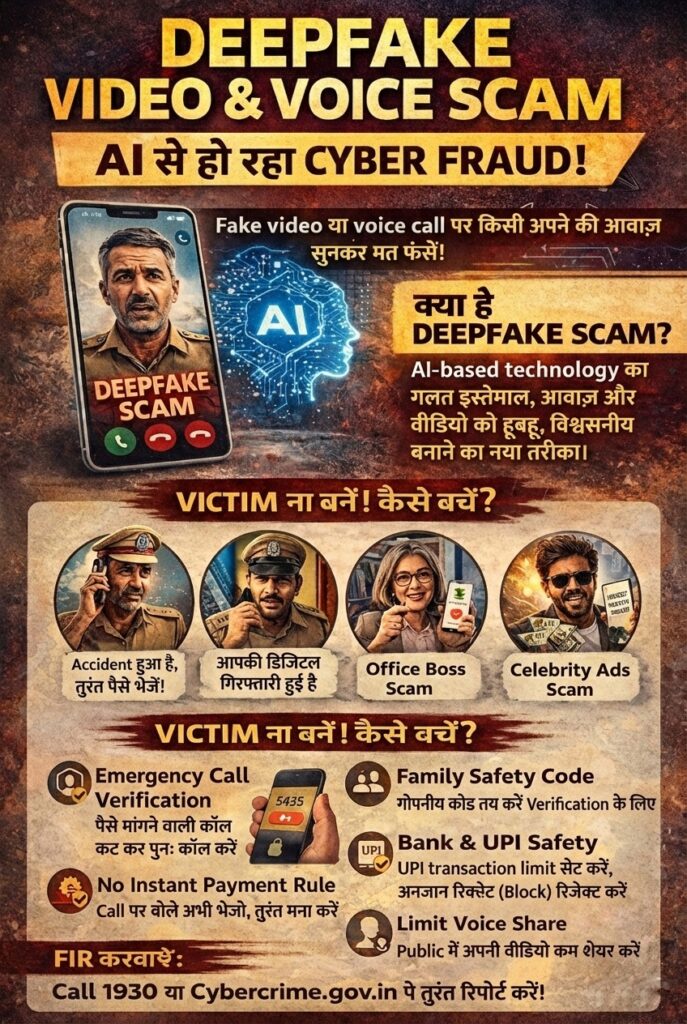

How Innocent Crypto Sellers Get Trapped

In many reported cases, the buyer uses money obtained from cyber fraud, phishing, or identity theft.

The crypto seller, unaware of this background, accepts the payment and transfers crypto.

When the original fraud victim files a cyber crime complaint, investigators trace the money trail.

Once the trail reaches the seller’s bank account, the account is flagged as a “beneficiary account”.

This leads to a debit freeze — often without prior notice.

Why Banks Freeze the Entire Account (Not Just the Disputed Amount)

Banks act under instructions from investigating authorities to prevent dissipation of suspected proceeds

of crime. In practice:

- Entire account debit is frozen

- Salary credits continue but cannot be used

- Business operations halt

- EMIs, vendor payments, and GST obligations are disrupted

This is a procedural safeguard, not a declaration of guilt.

Legal Framework Governing Bank Account Freezes

1. CrPC Section 102

Allows police to seize or prohibit operation of property suspected to be linked to an offence.

Bank accounts fall under “property” as interpreted by courts.

2. Information Technology Act, 2000

- Section 66D – Cheating by personation using computer resources

3. Indian Penal Code (Now Bharatiya Nyaya Sanhita)

- IPC 420 → BNS Section 318 (Cheating)

- IPC 406 → BNS Section 316 (Criminal breach of trust, where applicable)

Importantly, these sections apply based on intent and knowledge — not mere receipt of funds.

Account Freeze Does NOT Mean You Are an Accused

In a majority of P2P crypto freeze cases:

- The account holder is not named as an accused

- The freeze is for investigation purposes

- No FIR is registered against the seller initially

Courts have repeatedly held that innocent beneficiaries must be given an opportunity to explain

the transaction.

Cities Where Crypto P2P Freeze Cases Are Rising

- Delhi

- Mumbai

- Bengaluru

- Hyderabad

- Pune

- Noida & Gurugram

- Chennai

- Ahmedabad

These regions see high crypto usage combined with extensive UPI-based fraud networks.

Immediate Steps for Affected Individuals (Awareness)

- Preserve all transaction records

- Download bank statements showing credit source

- Save P2P platform chats and escrow confirmation

- Do not attempt fund withdrawals or transfers

- Maintain cooperation with investigating agencies

Application Format for Bank Account Unfreeze (Awareness Sample)

To, The Cyber Crime Investigation Officer, [City / District] Subject: Request for review and debit unfreeze of bank account linked to P2P crypto transaction Respected Sir/Madam, I respectfully submit that my bank account bearing number __________ has been debit frozen in connection with a cyber crime investigation. I state that the amount credited to my account was received against a genuine cryptocurrency P2P transaction executed through an escrow-based platform. I had no knowledge or intent regarding any alleged fraudulent source of funds. I am enclosing transaction details, wallet proof, and bank statements for verification. I humbly request a review of my account status in accordance with law. Yours sincerely, [Name] [Contact Details]

Preventive Awareness for Crypto Users

- Accept payments only from same-name bank accounts

- Avoid third-party transfers

- Record every transaction

- Refuse urgency-based crypto deals

- Educate family members about cyber fraud patterns

Request Legal Awareness Consultation

If an individual is facing issues related to a bank account freeze arising from

a cryptocurrency transaction, understanding the legal procedure and documentation may request consultation.

Disclaimer

This article is published for general legal awareness only.

It does not constitute legal advice, solicitation, or advertisement.

The content is based on reported cyber crime patterns, publicly available legal provisions,

and general informational material.

Readers are advised to verify facts independently and consult appropriate authorities.