Business Account Frozen Due to Customer Fraud: Legal Rights, Bank Action & Unfreeze Process in India

This article is published by The Legal Warning India and written by Advocate Uday Singh.

Introduction

In recent years, a growing number of business owners across India have faced an unexpected and financially

crippling situation — their business or current account suddenly frozen by the bank.

In many cases, the business owner has not committed any wrongdoing.

Instead, the freeze occurs due to fraudulent activity by a customer or third party.

Such freezes can disrupt salaries, vendor payments, GST compliance, loan EMIs, and daily operations.

This article explains why business accounts are frozen, the legal framework involved,

and the correct procedure to seek unfreezing.

What Does “Business Account Frozen” Mean?

When a bank freezes a business account, it usually restricts:

- Debit transactions (outgoing payments)

- UPI, IMPS, NEFT, RTGS transfers

- ATM withdrawals (if applicable)

- Cheque clearing

In most cyber-related cases, credit entries may still be allowed, but outgoing transactions remain blocked

until investigation is completed.

How Customer Fraud Leads to Business Account Freeze

A business account may be frozen when:

- A customer makes payment using stolen or fraudulent funds

- Money is transferred from a hacked account or mule account

- UPI or online transaction is later reported as unauthorized

- A cyber crime complaint names the business account as beneficiary

Once a complaint is registered, banks act under regulatory and law-enforcement directions to

prevent further movement of suspected funds.

Common Scenarios Seen in Practice

- Online seller receives payment for goods, later marked as fraud

- Service provider paid via UPI from compromised account

- Business unknowingly receives funds routed through scam chain

- Customer reverses allegation after dispute or chargeback

Legal Basis for Freezing Business Accounts

Banks do not freeze accounts arbitrarily. They act under:

- Information Technology Act, 2000 – cyber fraud provisions

- Bharatiya Nyaya Sanhita (BNS) – cheating, fraud, and conspiracy offences

- RBI KYC / AML Guidelines

- Police or Cyber Crime Cell written instructions

Relevant Legal Provisions (Indicative)

- IT Act Section 66D – Cheating by personation using computer resources

- BNS provisions replacing IPC 419 & 420 – Fraud and dishonest inducement

- BNS conspiracy provisions (where transaction chain is suspected)

Importantly, mere receipt of funds does not automatically make the business owner an accused.

Difference Between Accused and Beneficiary Account

Many business owners panic believing they are accused. In reality:

- Most business accounts are marked as “beneficiary accounts”

- Freeze is precautionary, not punitive

- Investigation aims to trace money flow, not assume guilt

Impact on Business Operations

- Salary payments blocked

- Vendor & supplier defaults

- GST and statutory compliance issues

- Loan EMI bounce risk

- Reputation and operational damage

Immediate Steps a Business Owner Should Take

- Contact bank branch and obtain freeze reason in writing

- Request copy of cyber crime reference or notice

- Preserve invoices, contracts, delivery proof

- Prepare transaction justification documents

- Do not attempt fund movement through alternate accounts

Documents Usually Required for Unfreeze

- Business registration documents

- Invoices related to disputed transaction

- GST returns / bank statements

- Customer communication proof

- Written explanation of transaction nature

Application to Cyber Crime Unit (Overview)

An application may be submitted requesting review of freeze,

clearly stating:

- Business had no role in fraud

- Transaction was bona fide commercial receipt

- Supporting documents enclosed

Can Partial Unfreeze Be Requested?

Yes. In several cases, authorities allow:

- Debit limited to salary payments

- GST payment permissions

- Operational expense releases

Timeframe for Unfreezing

There is no fixed statutory timeline. However:

- Simple beneficiary cases: 2–6 weeks

- Complex transaction chains: longer

- Delay often due to incomplete documents

What If Bank Does Not Respond?

- Written representation to nodal officer

- Escalation under RBI grievance mechanism

- Legal representation before appropriate forum (where advised)

Important Do’s and Don’ts

- Do not ignore freeze notices

- Do not conceal information

- Do not rely on verbal assurances only

- Do maintain professional documentation

Related Cyber Legal Awareness

-

Cyber Crime Bank Account Unfreeze – Legal Process

-

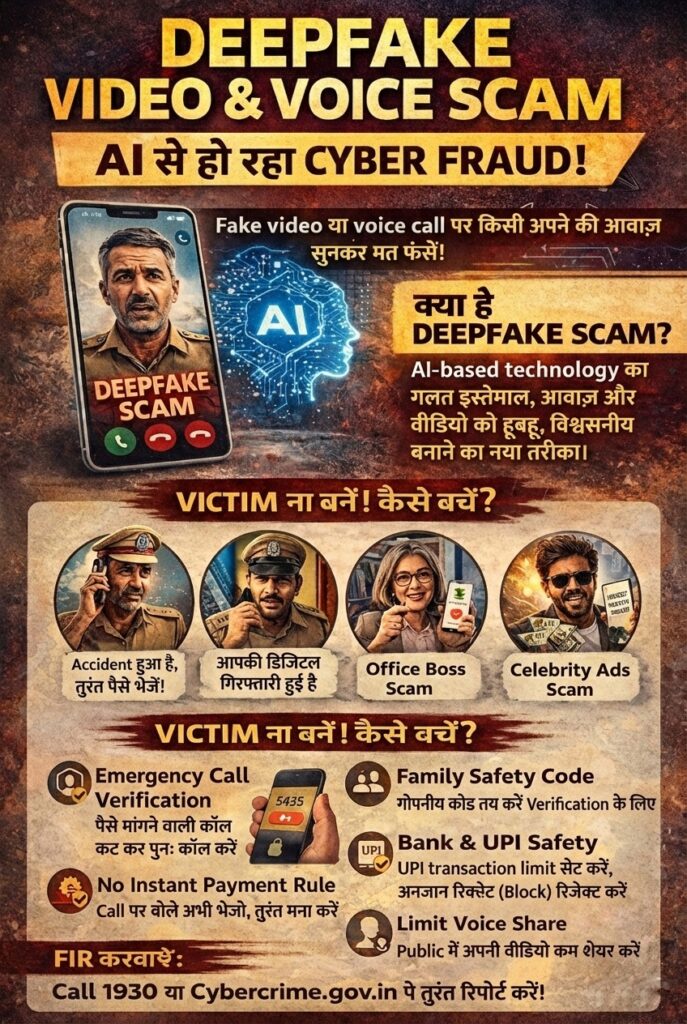

Deepfake & Digital Fraud Awareness

-

Online Blackmail & Sextortion Awareness

Request Legal Guidance

For understanding applicable procedures and remedies under Indian law.

Disclaimer

This article is published solely for general legal awareness.

It does not constitute legal advice, solicitation, or advertisement.

Information is based on prevailing legal provisions, reported cyber crime patterns,

and publicly available regulatory frameworks.

Readers are advised to independently verify facts and consult appropriate authorities where required.