ATM Swap Fraud Scam: How Cards Are Replaced, Money Is Stolen & What Victims Must Do Immediately

What Is an ATM Swap Fraud Scam?

ATM Swap Fraud is a form of card-based cyber fraud where a criminal physically replaces a victim’s ATM/Debit card with a fake or similar-looking card and later withdraws money using the original card.

Most victims realize the fraud only after money is debited, often within minutes or hours. This scam is rising rapidly across Delhi, Mumbai, Bengaluru, Hyderabad, Pune, Chennai, Noida, Gurugram, Ahmedabad, and other urban centers.

How ATM Swap Fraud Actually Happens (Step-by-Step)

1. Target Selection

Criminals usually target:

- Senior citizens

- First-time ATM users

- People withdrawing cash at isolated ATMs

2. Distraction at ATM Booth

The fraudster pretends to:

- “Help” with cash withdrawal

- Say the machine is not working

- Point out an error or stuck card

3. Card Swap Moment

During the distraction, the victim hands over the card, and the criminal swaps it with a similar-looking dummy card.

4. PIN Exposure

The PIN is either observed directly or obtained by manipulation while “helping”.

5. Rapid Cash Withdrawal

Within minutes, cash is withdrawn, ATM limits are maxed out, and sometimes purchases are made.

Why ATM Swap Fraud Is Still So Effective

- Physical fraud feels “less suspicious” to victims compared to online hacking.

- Many ATMs still lack guards or functional CCTV.

- Victims delay blocking cards.

- Criminals act very fast (the golden 30–60 minutes).

⚠️ Common Warning Signs After Card Swap

- ATM receipt doesn’t match your account.

- Card looks slightly different.

- Sudden SMS alerts for withdrawals.

- ATM card not working later.

- Bank says “transaction successful” but cash not received.

🚨 Immediate Steps Victims MUST Take (Golden Hour Actions)

First 30–60 minutes are crucial.

- Block the ATM/Debit Card Immediately: Call the bank helpline or use the mobile banking app.

- Register Complaint with Bank: Note the complaint/reference number.

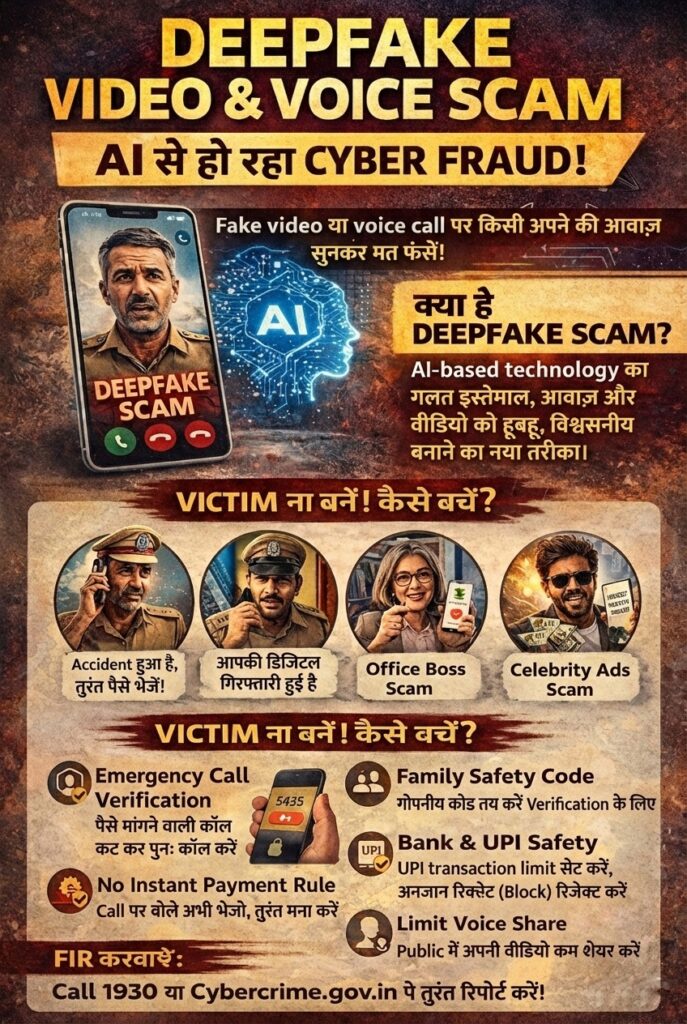

- File Cyber Crime Complaint: Through official cyber crime reporting channels.

- Visit Nearest Police Station: File a written complaint/FIR if the amount is significant.

- Preserve Evidence: ATM slip, SMS alerts, CCTV location & time, and bank statements.

Legal Provisions Applicable in ATM Swap Fraud

Depending on facts, the following may apply:

Indian Penal Code (IPC)

- Section 379: Theft

- Section 420: Cheating

- Section 419: Cheating by personation

Bharatiya Nyaya Sanhita (BNS)

Corresponding provisions for cheating, fraud, and theft.

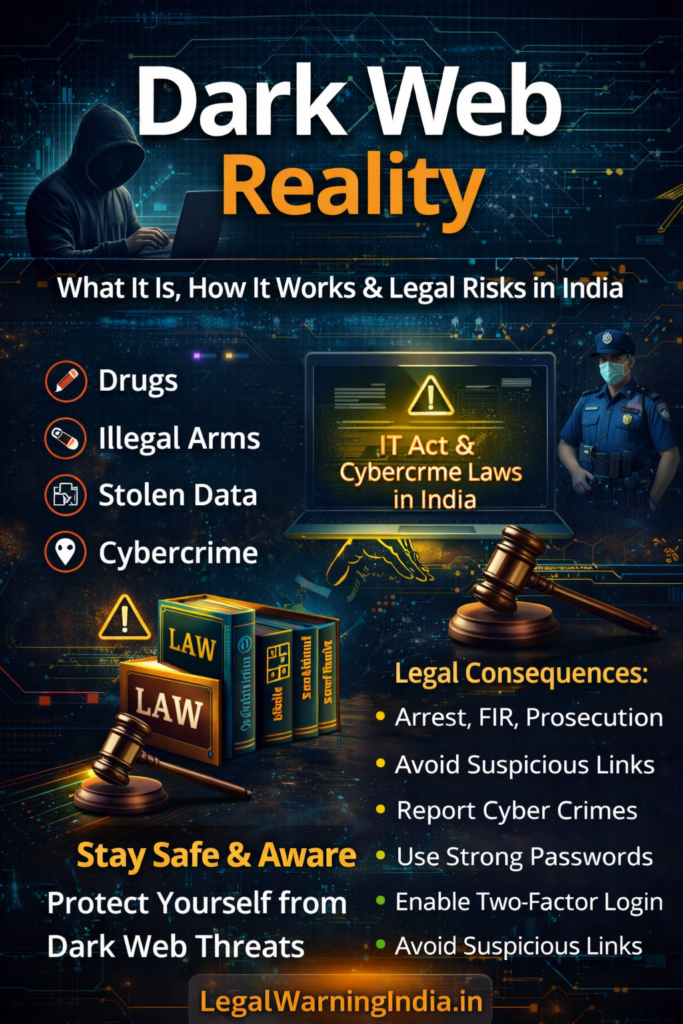

Information Technology Act, 2000

- Section 66C: Identity theft

- Section 66D: Cheating by personation using computer resources

Bank Liability: Will the Bank Refund the Money?

Refund depends on the speed of reporting, negligence assessment, and RBI guidelines on zero liability.

- Key Point: If reported immediately, the customer may have zero or limited liability.

- Delay can shift liability to the customer.

- CCTV footage plays a crucial role.

ATM Swap Fraud vs ATM Skimming

Preventive Measures Everyone Must Follow

- Never hand over ATM card to anyone.

- Cover keypad while entering PIN.

- Avoid isolated ATMs at night.

- If help is needed, cancel the transaction and leave.

- Do not engage with strangers inside ATM booths.

Legal Awareness & Guidance

यदि कोई व्यक्ति ATM Swap Fraud या किसी अन्य साइबर अपराध से प्रभावित है,

तो भारतीय कानून के अंतर्गत उपलब्ध प्रक्रियाओं और उपायों की जानकारी होना आवश्यक है।

यह जानकारी केवल सामान्य विधिक जागरूकता के उद्देश्य से साझा की जा रही है।

Note: यह किसी प्रकार का विज्ञापन या सॉलिसिटेशन नहीं है।

This article is published solely for legal awareness and educational purposes. It does not constitute legal advice, solicitation, or advertisement. The information is based on commonly reported fraud patterns, banking procedures, and general legal provisions. Readers are advised to verify facts independently and approach appropriate authorities where required.