Money Laundering via Dark Web: Legal Perspective Under PMLA

This article is published by The Legal Warning India and written by Advocate Uday Singh.

Introduction

The rise of the dark web has fundamentally altered the landscape of financial crime.

What was once limited to traditional hawala networks and shell companies has now evolved

into complex digital laundering mechanisms involving cryptocurrencies, anonymized marketplaces,

and cross-border cyber networks.

Indian enforcement agencies are increasingly encountering cases where illegal proceeds

are routed through dark web channels, triggering action under the

Prevention of Money Laundering Act, 2002 (PMLA).

Understanding the Dark Web in Financial Crime

The dark web refers to hidden online networks accessible through specialized software

such as Tor. These platforms are designed to conceal user identities, making them

attractive for illicit activities including narcotics trade, arms trafficking,

data breaches, and financial fraud.

In the context of money laundering, the dark web acts as an intermediary layer

where proceeds of crime are disguised, transferred, or converted before entering

the formal banking system.

How Money Laundering Occurs via the Dark Web

- Conversion of illegal cash into cryptocurrency through informal channels

- Use of dark web marketplaces for layering transactions

- Employment of mixing and tumbling services to obscure transaction trails

- P2P crypto exchanges and mule accounts for integration

- Cross-border transfers avoiding regulated exchanges

Cryptocurrency and the Laundering Ecosystem

Cryptocurrencies are not illegal in India; however, their misuse becomes a serious

legal concern when linked to proceeds of crime.

Dark web laundering often exploits:

- Privacy-focused coins

- Decentralized wallets with no KYC

- Peer-to-peer transactions without regulated oversight

PMLA: Legal Framework Against Dark Web Laundering

The Prevention of Money Laundering Act, 2002 provides the statutory framework

to deal with laundering of proceeds derived from scheduled offences.

Key Elements Under PMLA

- Proceeds of Crime: Any property derived from criminal activity

- Process or Activity: Concealment, possession, acquisition, or use

- Projection as Untainted: Attempt to legitimize illegal funds

When funds originating from cyber crime, fraud, or darknet transactions

are introduced into bank accounts or crypto exchanges,

PMLA provisions become applicable.

Role of Enforcement Directorate (ED)

The Enforcement Directorate is the primary agency responsible for

investigating PMLA offences.

In dark web-linked laundering cases, ED may:

- Provisionally attach bank accounts and crypto assets

- Summon account holders, exchange operators, and intermediaries

- Trace digital wallets and transaction histories

- Coordinate with cyber crime units and international agencies

Account Freezing and Asset Attachment

One of the most immediate consequences faced by individuals is the freezing

of bank accounts and digital assets.

Even indirect involvement—such as receiving funds unknowingly—can trigger

temporary attachment until the source of funds is verified.

Innocent Account Holders and Legal Complexity

A significant number of PMLA-linked dark web cases involve individuals who

claim no knowledge of the illicit origin of funds.

Indian courts have repeatedly emphasized the importance of intent and

knowledge; however, the burden of explanation often lies on the account holder

during investigation.

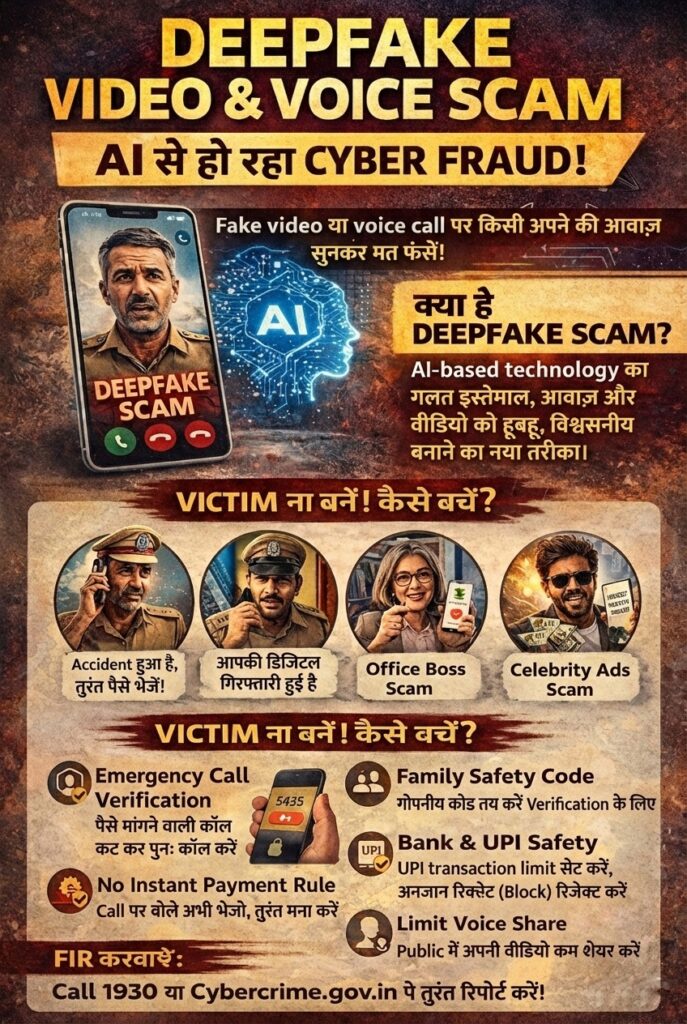

Interplay with Cyber Crime Laws

Money laundering via the dark web is rarely a standalone offence.

It often intersects with:

- Cyber fraud and cheating offences

- Identity theft and impersonation

- Illegal data trade

- Cross-border financial crimes

International Dimension of Dark Web Laundering

Dark web transactions frequently involve servers, wallets, and actors

located outside India.

This necessitates cooperation through:

- Mutual Legal Assistance Treaties (MLATs)

- Financial Intelligence Units (FIU)

- Global crypto compliance mechanisms

Judicial Trends and Observations

Indian courts have acknowledged the evolving nature of digital financial crime.

Judicial scrutiny increasingly focuses on:

- Source tracing rather than mere possession

- Proportionality of account attachment

- Safeguards for genuine account holders

Preventive Awareness for Individuals and Businesses

- Avoid accepting unexplained crypto or bank transfers

- Maintain proper transaction documentation

- Use only compliant exchanges and platforms

- Respond promptly to official notices

Conclusion

Money laundering through the dark web represents one of the most complex challenges

for modern financial regulation.

While the PMLA equips Indian authorities with strong enforcement tools,

awareness, compliance, and timely legal understanding remain critical

to prevent collateral damage to innocent individuals.

Request Legal Guidance

If a person is facing legal issues related to cyber crime, bank account freeze,

online fraud, money laundering allegations, or dark web related concerns,

they may seek general legal guidance to understand available remedies and procedures

under Indian law.

This information is shared strictly for general legal awareness and

does not constitute solicitation or advertisement.

Disclaimer

This article is published strictly for general legal awareness.

It does not constitute legal advice, solicitation, or advertisement.

The analysis is based on publicly available laws, reported enforcement practices,

and judicial trends. Readers are advised to verify facts independently

and consult appropriate authorities where required.