Business Bank Account Frozen Due to Cyber Crime – How to Get It Unfrozen Legally

This article is published by The Legal Warning India and written by Advocate Uday Singh.

Why Are Business Accounts Frozen in Cyber Crime Cases?

In recent years, a large number of business current accounts, merchant accounts, and startup bank accounts

have been frozen due to cyber crime complaints.

This usually happens when a disputed transaction is traced to a business account during investigation.

Importantly, in many cases the business owner is not the accused, yet the entire account is frozen as a

precautionary measure.

Common Reasons for Business Account Freeze

- Customer filed a cyber fraud complaint

- Online payment received from disputed source

- Business linked to online gaming or digital services

- Account flagged during money trail investigation

- Bank received freezing instruction from Cyber Crime Unit

Is It Legal to Freeze the Entire Business Account?

Banks generally act under instructions from law enforcement agencies.

However, blanket freezing of the entire business account

without proportionality can severely affect livelihood and operations.

Courts have repeatedly observed that:

- Only disputed amount should be restricted where possible

- Business continuity must be considered

- Freezing should be reviewable and time-bound

Relevant Legal Provisions (India)

- IT Act, 2000 – Section 66D (Cyber cheating)

- Bharatiya Nyaya Sanhita (BNS) – Cheating & fraud provisions

- CrPC / BNSS – Powers of investigation and seizure

- RBI Guidelines on freezing of bank accounts

Immediate Steps Business Owners Should Take

- Obtain written freeze notice or email from bank

- Identify disputed transaction amount

- Collect invoices, contracts, GST filings, bank statements

- Approach concerned Cyber Crime Police Station

- Submit formal unfreeze application

Format: Application for Unfreezing Business Account Due to Cyber Crime

To The Station House Officer Cyber Crime Police Station [City / District / State] Subject: Application for Unfreezing Business Bank Account Frozen Due to Cyber Crime Complaint Respected Sir/Madam, I am the proprietor/authorized signatory of [Business Name], having bank account number [Account Number] maintained with [Bank Name & Branch]. I respectfully submit that my business account has been frozen pursuant to a cyber crime complaint, in which a transaction amount of ₹[amount] is under verification. I state that: • My business is legitimate and duly registered • The disputed amount has been received during normal course of business • I am fully cooperating with the investigation • Freezing of the entire account is causing severe operational hardship I hereby undertake to assist the investigation and provide all required documents. In view of the above, I humbly request that my business account may kindly be unfrozen, or alternatively, restrictions may be limited only to the disputed amount. Thanking You. Yours faithfully, Name: Designation: Business Name: Mobile Number: Date:

What If Police Does Not Respond?

- Submit reminder application

- Approach senior cyber officers

- Send representation to bank nodal officer

- Legal remedy before appropriate court may be explored

Preventive Measures for Businesses

- Maintain KYC records of clients

- Avoid suspicious payment sources

- Document all online transactions

- Use escrow or verified payment gateways

Related Cyber Crime Legal Guidance

- Cyber Crime Bank Account Unfreeze – Legal Guide

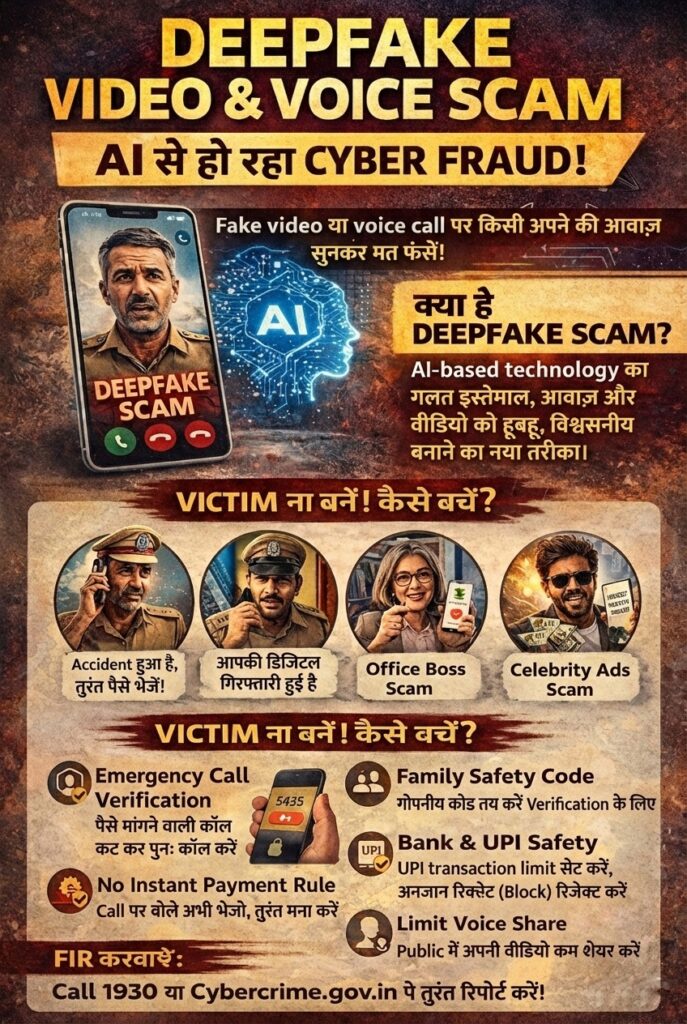

- Deepfake & Online Fraud Awareness

- Online Blackmail & Sextortion Legal Awareness

Request Legal Consultation

For lawful guidance on cyber crime account freeze matters, procedural remedies,

and compliance-based solutions, a legal consultation may be requested.

Disclaimer

This article is published for general legal awareness only.

It does not constitute legal advice, solicitation, or advertisement under

Bar Council of India Rule 36.

Information is based on reported cases, statutory provisions, and public domain sources.